The infographics below are derived from data contained in

BMC's DrinkTell™ Database with Market Forecasts

|

|

| EXAMINING HEALTHY BEVERAGE OPPORTUNITIES AMONG COLLEGE STUDENTS - A CRASH COURSE |

College age students have shown a predilection for healthy beverages, according to Beverage Marketing Corporation's DrinkTell™ database. In collaboration with Riddle & Bloom (formerly, Fluent), Beverage Marketing surveyed over 800 college students from across the U.S. on their behaviors and attitudes towards beverages in 2017. The survey, which is contained in DrinkTell™, offers some interesting insights and also offers marketers a track to run on when student responses regarding attitude, consumption and intent to consume are compared against DrinkTell™ data on total market sales volume growth for various beverage types.

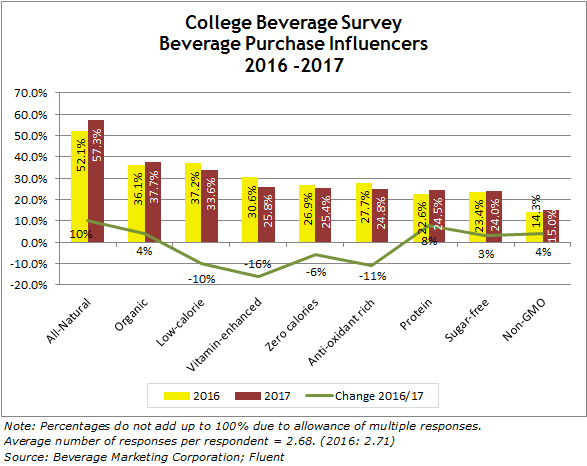

Healthy Words Make a Difference

One question asked was "Which descriptors most favorably impact your decision to drink a particular beverage? Choose up to 3." According the BMC/Riddle & Bloom survey, All-natural scored highest, with 57.3% of respondents picking it as one of their top three descriptors. All-natural even outscored organic, which was chosen by 37.7% of respondents. The term low-calorie was cited by 33.6% of respondents, comfortably ahead of descriptors of the same ilk such as zero calories (25.4%) and sugar-free (24.0%). But of the three descriptors, only sugar-free grew in share in 2017. Protein was cited by 24.5% of surveyees, up by 8% versus 2016, while non-GMO was flagged by 15.0%, up by 4% from the year-ago period. In contrast, college students were less likely to cite antioxidant-rich or vitamin-enhanced as a beverage purchase influencers in 2017 as compared to 2016. |

|

Kombucha and Protein Drinks - Lessons to Learn

Examining student actions and intent vs. general market trends can provide insights for marketers. Consider kombucha and protein drinks...

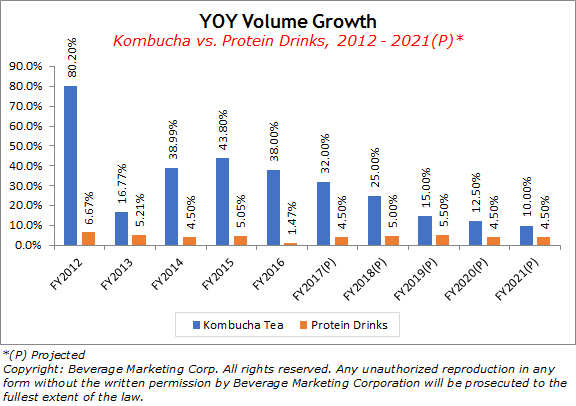

The college age student survey can be compared and contrasted with total market volume to measure the congruence of college students with the rest of the population. According to total market kombucha and protein drink data contained in DrinkTell™, kombucha consumption in the total population grew much more significantly than protein drinks in 2016, with this pattern holding up (if moderating) in the next five years. |

|

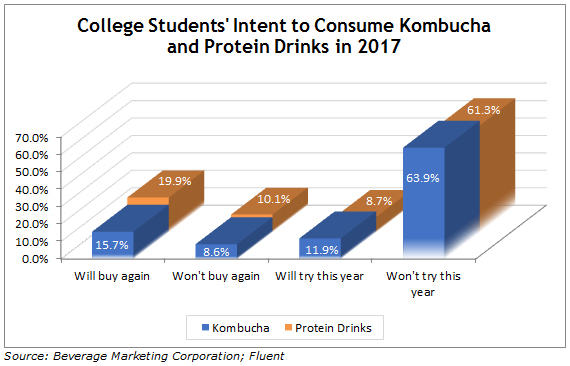

Kombucha and protein drinks, on the other hand, show less divergence among the college age population, at least when measured by future intent. To clarify, students were asked to choose one of four statements concerning a specific beverage in 2017: "Have purchased and will purchase again," "Have purchased and will not purchase again," "Have not purchased but plan to purchase this year" and "Have not purchased and do not plan to purchase this year." Of the students who had already tried protein drinks and kombucha before, nearly twice as many said they would buy them again (as opposed to not buy them again). In fact, protein drinks came out slightly better in terms of repeat purchase intent than kombucha. |

|

On the other hand, of those who hadn't tried either beverage, more students indicated a willingness to try kombucha than protein drinks. It should be noted that over 60% of respondents had never tried kombucha or protein drinks and had no intent to take the plunge in 2017. While this would seem pessimistic at first glance, it also provides an opportunity to marketers to improve their targeting of the college age audience. While these examples represent just a few of the qualitative and quantitative insights to be gleaned through Beverage Marketing's DrinkTell™ database, they illustrate the importance of viewing data from multiple angles for maximum perspective when identifying and sizing opportunities and developing strategies and tactics for capitalizing on them. Beverage Marketing offers complementary demos of the DrinkTell™ database upon request. |

|

|