| WHEN VOLUME IS CONCENTRATED AMONG A LIMITED NUMBER OF BRANDS |

Sunday was National Cognac Day. Rémy Martin urged aficionados to celebrate with a tasty looking Sidecar and several creative variants. (Where would our marketers be without classic cocktails and the romantic appeal of the 1920s?) Rémy also shone its promotional spotlight on the Sazerac and French 75. Our reaction was to plunge into DrinkTell™.

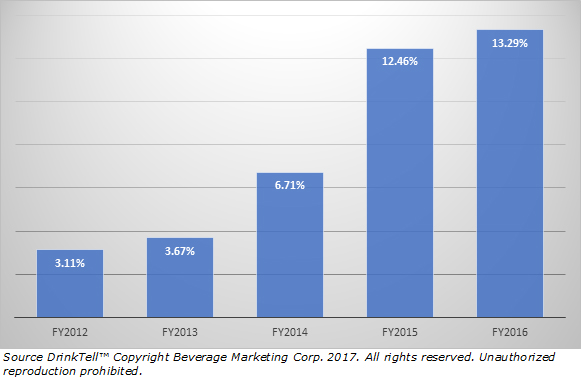

While perhaps not as big a story as the Whiskey surge the accelerating growth of Cognac sales is an important story in its own right. Domestic cognac consumption has taken off in recent years with total market depletions jumping from 3.95 million cases in 2013 to 5.37 million last year (2016). Cognac is also strong globally with increasing sales reported in China and the U.K. |

YOY Volume Growth

|

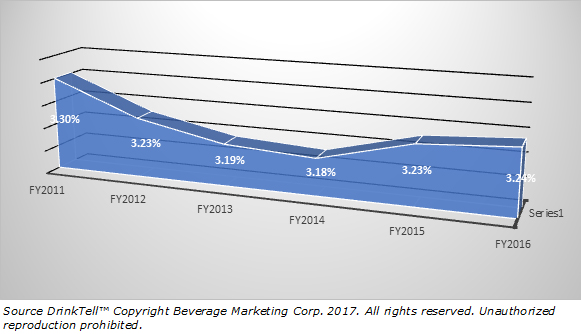

But—and this is true on the international scene as well as here in the U.S.—the supplier market remains intensely concentrated. We track about 20 brands in DrinkTell™. Those 20 brands account for almost 97% of all U.S. volume. That proportion does not appear to be changing. The volume share of brands outside the top 20 was 3.3% in 2011 and it hasn't been that high since then. Most important there's been only one new entry to the list since 2011. That was Bacardi's highly targeted d'Ussé. Supplier concentration, a classic barrier to entry, appears to be hard at work. |

Volume Share of Cognac Brands Outside the Top 20

|

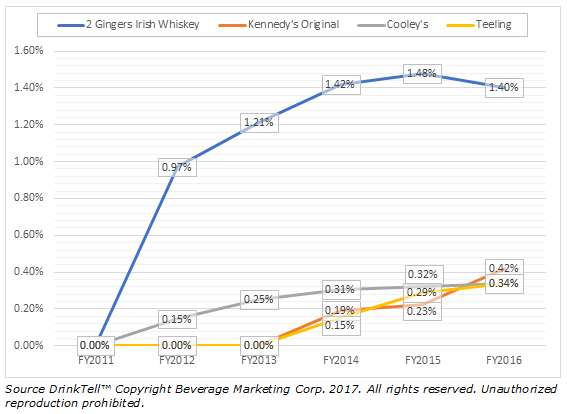

But is that always the case? We looked in DrinkTell™ for a counterpoint. Irish Whiskey appears to be just that. The supplier market, which grew from 1.7 million cases in 2011 to almost 3.7 million in the U.S. last year, is from year to year at least as concentrated as the Cognac market. In DrinkTell™ we're tracking a couple of more brands (22) and last year saw those 22 account for almost 98.5% of total U.S. depletions. In 2011 the number for those same 22 was closer to 99%. But four new brands joined our U.S. parade in that time. That means four others which would have been part of an analogue six years ago are gone. Now it is the newbies who appear to be gaining a at least a foothold. The line chart tracks these brands which were not available here in 2011. |

Irish Whiskey Volume Share by Brand

|

Bottom line, an expanding market, even a highly concentrated one, may have room for new entries. Yes, in some categories supplier concentration can be a barrier to all but the most targeted entries. It does not always have to be. DrinkTell™ data can help guide your own evaluation. For questions or to look at our DrinkTell™ database yourself just give us a call. To order a BMC U.S. Wine, Beer, or Spirits Guide, 2017 edition, just click below. |