The infographics below are derived from data contained in

BMC's DrinkTell™ Database with Market Forecasts

|

|

| BORN FREE, TAXED TO DEATH? |

Last week the D.C. based Tax Foundation, a nonprofit tax policy research and lobbying group released its 2017 State Wine Tax Map, headlined "How High Are Wine Taxes in Your State?" The group considers itself not just a researcher but also an advocate for pro-growth policies. So, the map begs the question as to the effect of state beverage alcohol excise taxes on consumption—if it is, in fact, measurable.

This question seemed ripe to us for some database researching that we hoped DrinkTell™ might provide. Since last fall's election there's been a lot of talk about lowering the Federal Excise Tax on beverage alcohol. Whether that can happen now in the current political climate is anyone's guess. The FET has long been a bugaboo for the distilled spirits industry. The Distilled Spirits Council (DISCUS) has criticized both its negative economic impact and its discrimination against spirits as opposed to beer and wine "Almost three times wine and two times beer," they say on their web site.

Last year the FET was $13.50 per proof gallon of spirits, or $2.14 on an 80 proof 750 ml. It was $1.07 on a wine gallon of 14% alcohol or less. That's $0.21 on a 750 ml. And it was $18 on a 31-gallon barrel of beer with a reduced rate carved out for the first 60,000 barrels of brewers who produced less than 2 million barrels annually. That's about a nickel a can. (Note that the unfair comparison mentioned previously is calculated when equivalent amounts of alcohol are compared, not simply volumes of liquid.)

Since the FET is common to all the states, we thought looking at the potential impact of state excise taxes, which are incremental and different in each state, might uncover something. Since the Tax Foundation also noted that the State Wine Tax Map was one of the most read of its recent news items, we considered that others may have thought something similar. |

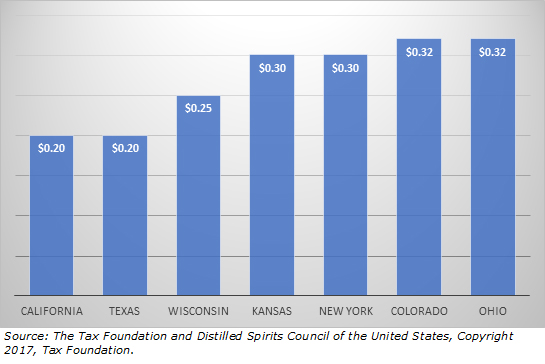

State Wine Excise Tax

|

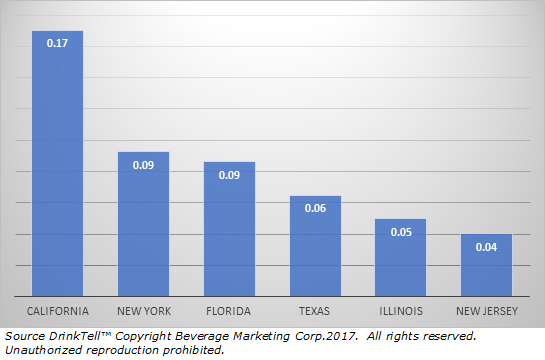

The Wine Tax bar chart shows the states with the lowest wine excess tax rates. In the next chart, below, you can see the top states in terms of wine per capita volume share (%). Some of the biggies are in both places but it's not a convincing match. That's because four states not on the per capita volume chart but on the bottom end of wine taxing states are Wisconsin, 18th in per capita volume, Kansas 44th, Colorado 18th, and Ohio, 12th. You could argue some correlation but we think that if you expected to see people drinking more wine because they could save a few dimes per bottle you're disappointed. |

Wine Per Capita Volume Share 2016

|

Some of the biggies are in both places. Those that are, however, California, New York, and Texas are all states that are just as likely looking out for the interests of their domestic wine industries with their tax policies as they are hoping that their residents will drink a little bit more vino.

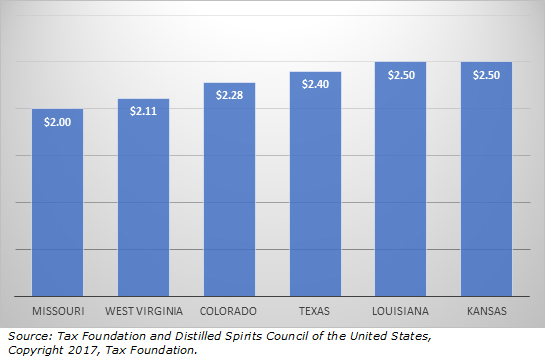

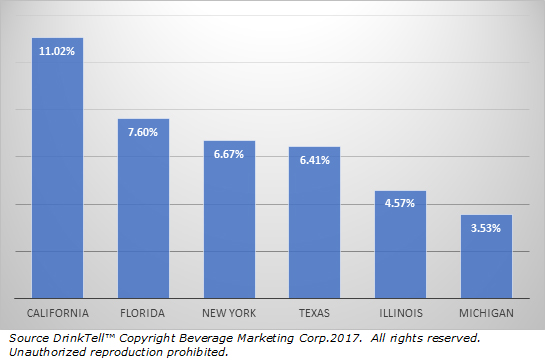

To round out the picture we looked at the states with lowest spirits excise taxes, again courtesy of a tax map put out by the Tax Foundation last June, and compared it with the leading states in terms of per capita spirits consumption last year. The result was that for all intents and purposes there was no comparison. Keep in mind that in many states the spirits excise tax is hefty and does in fact have a noticeable effect on retail prices. Since we're talking about associations here our analytic conclusions aren't proof positive. But they sure do seem to tell us that state excise taxes are not dissuading—or encouraging wine and spirits consumers. |

State Spirits Excise Tax

|

Spirits Per Capita Volume Share 2016

|

Issues raised in political discussion and by lobbying groups are rightly backed by (their own) statistics. But for dispassionate thinking about beverage industry issues like the ones discussed here unbiased volumetrics almost always have a story to tell. And one way to make sure the big picture is clear is to jump into a database like DrinkTell™. For questions or to look at our DrinkTell™ database yourself just give us a call. To order a BMC U.S. Wine, Beer, or Spirits Guide, 2017 edition, just click below. |

|

|