The infographics below are derived from data contained in

BMC's DrinkTell™ Database with Market Forecasts

|

|

| LOOKING FOR GROWTH IN ALL THE RIGHT PLACES |

As a patriotic beer-swilling American (since adolescence), I was shocked last week by a business page headline that all but screamed craziness. "Millennials are killing the beer industry" it read. What in the world, I wondered, are those crazy kids doing now? "Millennials aren't drinking enough beer to keep brands afloat," the mad report read. I shook my head. Could it be true? Anxious to reassure myself I turned to the DrinkTell™ database for the facts.

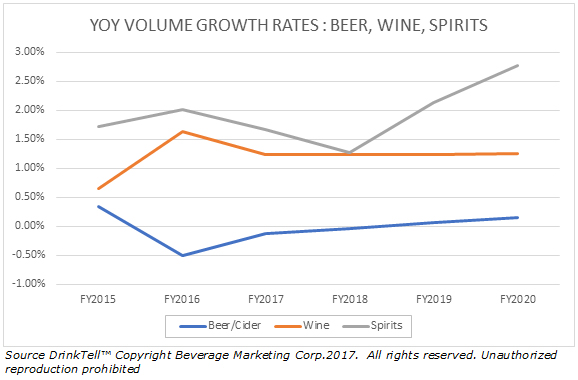

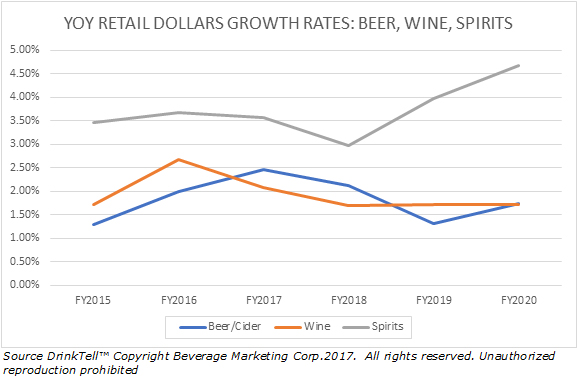

We know data indicates that Millennials as a group prefer wine. But Millennials, although now our largest population cohort, are also said not to have too much money. First we looked at current and projected volume growth. As we knew already beer is not winning any prizes. It's sliding. And total U.S. wine consumption is growing—modestly. We turned to retail dollars. Better there for beer, but nothing to crow about. Wine likewise. And wine volume's growth seems to be masking lesser gains at the cash register. Actually smiling like a Cheshire cat in all these comparisons is Spirits. |

|

|

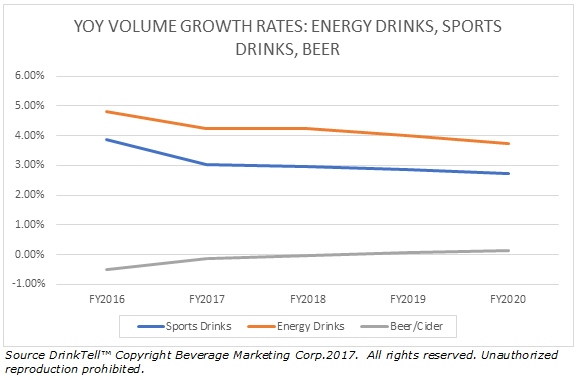

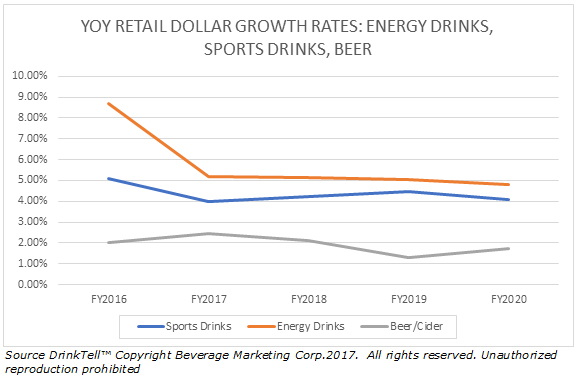

None of this is news, however. The news is what to do about it. That is to say, where to find incremental growth. Spirits, yes, and we are seeing that. Perhaps, however, it is also outside beverage alcohol but still within the beverage category. Our research took us straight back to the announcement last week that AB InBev was buying energy-drinks maker Hiball. Hiball also makes sparkling juices and water. Last year the brewer inked a deal with Starbucks to sell ready-to-drink tea.

The point really is growth. For marketers growth has to keep on coming. And they know it. Without it the crazy stories like the one we started with are no longer so crazy. Our opportunity radar suggests that AB's move could be a template for at least some other beverage alcohol marketers. Other big beverage companies (particularly marketers of carbonated soft drinks) are already expanding beyond the categories in which they build their world-recognized brands.

Here's a sample of what DrinkTell™ has to say about opportunities for a couple of areas for growth in greener pastures. Current and projected volume growth for both energy drinks and sports drinks is significantly greater than that for beer. The clincher in the comparisons is the significantly different growth in retail dollars, where the growth rates of both non-alcohol beverages is more than twice that for beer. |

|

|

Other areas where DrinkTell™ reveals very significant retail sales gains include cold brew coffee, vegetable/frjuit juice blends, plant water, coconut water, and RTD tea. The quest for sales and profit growth is a story repeated today across the U.S. in a myriad of markets where unanticipated change (isn't it always?) has shaken the certainties of giant businesses about what is true. Just a couple of days ago we were talking to a top on-premise sales executive at one of the largest wine and beer marketers. He told us how the slumping casual theme business had forced companies like his to totally rethink the question of growth and who their "new" customer base would be. His comments about regional and emerging chains have an unmistakable parallel in the thinking going on at AB InBev and elsewhere.

To guide your own thinking about these big picture questions there's nothing like a comprehensive database like DrinkTell™. For questions about this column or to look at our DrinkTell™ database yourself just give us a call. To order a BMC U.S. Wine, Beer, or Spirits Guide, 2017 edition, just click below. |

|

|