The infographics below are derived from data contained in

BMC's DrinkTell™ Database with Market Forecasts

|

|

| ARGENTINA TACKS INTO THE WIND—A GOOD IDEA OR NOT? |

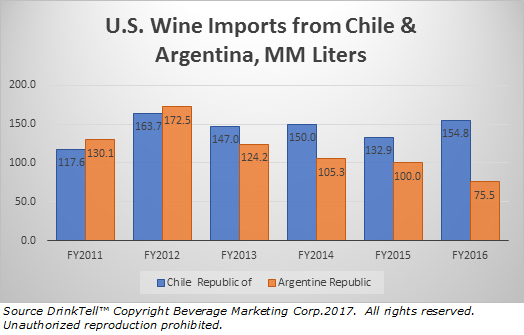

While production varies from year to year, the world's fifth and sixth largest wine producers are Argentina and Chile with Australia doggedly nipping at Chile's heels. Production of both South American countries has ranged in recent years from about 11 to 15 million hectoliters, according to the International Organization of Vine and Wine. There's often been little real daylight between the two. The pattern of U.S. imports from the leading South American producers is, however, a different story. |

|

Where Argentina once appeared to have an advantage in U.S. markets, at least in terms of volume, data from DrinkTell™ shows that it is now falling off the pace. That's why it was no surprise to read comments from a Trapiche spokesperson that smaller than average vintages are forcing Argentine wine producers to move into more premium segments. Beating into the wind is the sailor's best strategy to reach a desired port when conditions are not cooperating.

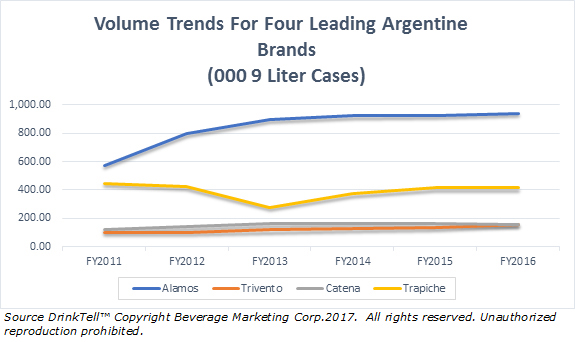

Looking at four of Argentina's top selling brands worldwide, all of which have a foothold in the U.S. market, reinforced the idea that change was already in the offing. Chile also had a short harvest season last year. But Trapiche marketing director Duncan Keen said the 2016 harvest simply speeded things up for him. He gave plenty of reasons for Argentine premiumization well beyond the short term ones. In the chart of top sellers below, U.S. volume is not actually falling off. But only Alamos seems not to be flat lining. |

|

On the world market Argentina finds itself at a disadvantage to Chile, which has more free trade agreements—meaning less of a tax burden and the ability to focus on price and volume.

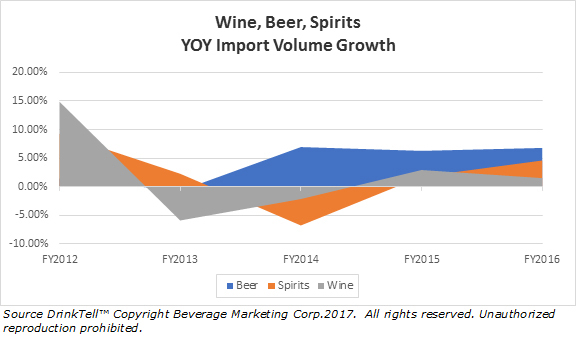

U.S. market conditions, by contrast, offer a different opportunity, one that Argentine marketers believe favors them—or at least is necessary. That's to focus on higher prices, specifically bottles with a $15-25 retail price. Keen pointed to rising retail and restaurant prices for California Cabernet as one reason for focusing on these higher priced bottles. In addition, the preference for wine among Millennials and their apparent willingness to spend more on wine than other groups did at their age may represent a long term open door.

So, if demographics is destiny, it is staring at us. In terms of YOY volume growth, wine imports as compared to those of beer and spirits is clearly underwater (area chart below). At the same time total domestic consumption has been growing. |

|

While the future will be the unimpeachable judge of marketing strategies, sailors and coaches both agree—if it ain't working, fix it. Data, like that we found in DrinkTell™ is on their side. To see what it's like to be your own coach, join us for a dip into DrinkTell™. For a database demo or just for questions about this column give us a call. To order a BMC U.S. Wine, Beer, or Spirits Guide, 2017 edition, click below. |

|

|