The infographics below are derived from data contained in

BMC's DrinkTell™ Database with Market Forecasts

|

|

| WHAT MAKES A BRAND? THE MILLION CASE QUESTION |

We could also have aptly titled this week's column "Why Numbers Matter" or maybe "Numbers Do Matter." A couple of days ago news website Business Insider featured a story titled "How tattoos and motorcycles helped Sailor Jerry's become the second biggest spiced Rum brand in the world." The story positioned Sailor Jerry as enduring flat sales until a couple of years ago when a revamped marketing strategy put it on a growth track and success it had not enjoyed before. The new strategy described was "embracing the heritage of Norman "Sailor Jerry" Collins, a tattoo artist and Navy veteran."

Key elements of the new effort included backing off TV campaigns and strengthening efforts involving digital and social media, event partnerships and working with complementary brands such as Harley Davidson. As part of their cooperative efforts, the two brands created a line of custom motorcycles. Tattoo imagery, now integrated more broadly into social media platforms, continues to be an important and successful part of current efforts. "It's all about creating a lifestyle and a story around the product," said an ad agency exec, quoted in the Business Insider story.

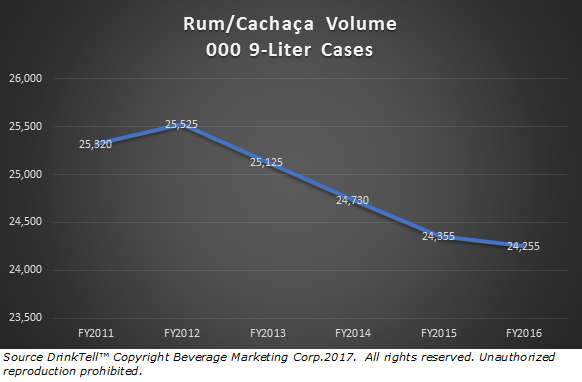

Now to some of the numbers we looked at in our database DrinkTell™ as evaluated by what we had read. First, we know that domestic Rum consumption is not going anywhere. "Flat" is a generous descriptor. |

|

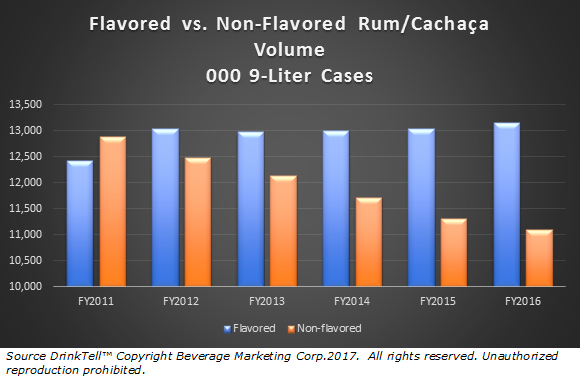

Favoring opportunity for a brand like Sailor Jerry's, we know that Rums of all types have maintained steady volumes in recent years and any category slide has been in unflavored expressions. |

|

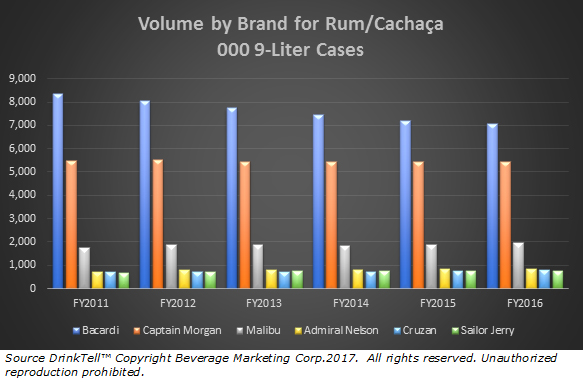

We also know that domestically Sailor Jerry's growth has actually slowed considerably the last 3-4 years. It is not a million-case brand in the U.S. and it has not really made any significant volume gains here versus Captain Morgan since 2012. |

|

And we also know that the new Sailor Jerry strategy is, well, not all that different from Captain Morgan in its essential approach to the marketplace—rather notably the focus on heritage, a brand icon and the targeted consumers' culture. It's hard to parse big differences in what Sailor Jerry has done and what Diageo's had already done to infuse the Captain into pop culture, and push a focus on storytelling and legends relating to their brand icon. (The power of Captain Morgan's One Million Poses campaign is another story—something few marketers besides Diageo could muster the resources for.)

Where Sailor Jerry is different and actually gaining on competitors in the U.S. is in retail dollars. A quick search of prices around the country shows a 750 ml of Sailor Jerry Original retailing at between $20 and $25, the high end of Rum's premium tier and just touching the fast growing super premium tier.

We haven't entered Sailor Jerry's 2016 retail sales into DrinkTell™ yet but based on earlier data, the brand has almost certainly surpassed Admiral Nelson and Cruzan in retail dollars. But in terms of Spiced Rum alone, high volume Captain Morgan with a bottom end 750 ml retail of around $14 is King as well as Captain of the comparison. |

|

We're just guessing here that the adventurous, non-conforming consumers who can buy custom Harleys can also spend a little more on their Spiced Rum than their perhaps younger, would-be adventurous, non-conforming consumers who pack the Captain Morgan fan base.

So why do we think that the numbers here matter? Not because we suspect Sailor Jerry marketers are fooling themselves. They obviously tracked their market well and are holding their own in their category. It's in terms of analyzing what's happening—watching marketers' feet rather than just reading their lips—that strategy itself can be discerned and possibly predicted and, we think, evaluated. For questions about this column or to look at our DrinkTell™ database yourself give us a call. To order a BMC U.S. Wine, Beer, or Spirits Guide, 2017 edition, just click below. |

|

|