Press Release: U.S. Liquid Refreshment Beverage Market Retail Dollars Grew Quickly in 2023 but Volume Declined, Reports Beverage Marketing Corporation

5/15/2024

U.S. LIQUID REFRESHMENT BEVERAGE MARKET RETAIL DOLLARS GREW QUICKLY IN 2023 BUT VOLUME DECLINED, REPORTS BEVERAGE MARKETING CORPORATION

***

Performance in 2023 reflects ongoing impact of inflation

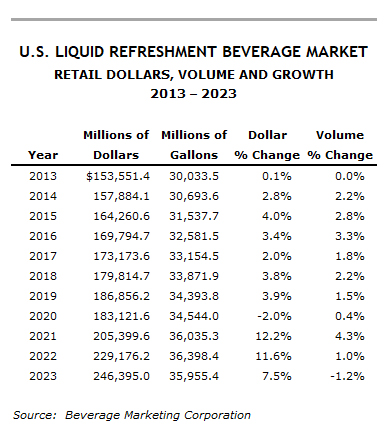

NEW YORK, NY, May 2024: U.S. liquid refreshment beverage retail sales grew rapidly in 2023, but volume was down compared to the previous year, according to newly released preliminary data from Beverage Marketing Corporation. While inflation remained pronounced, retail sales did not grow as fast in 2023 as they had in the preceding two years. Even so, high prices likely contributed to the dip in volume.

After surpassing 36 billion gallons in 2022, total liquid refreshment beverage volume slipped just below that level in 2023. Retail sales jumped from $229.2 billion in 2022 to $246.4 billion — an increase of 7.5%. In both 2022 and 2023, sales growth was mainly attributable to inflation. Just two liquid refreshment beverage segments experienced volume enlargement in 2023 but all of them registered sales increases, with one of them charting double–digit growth rates.

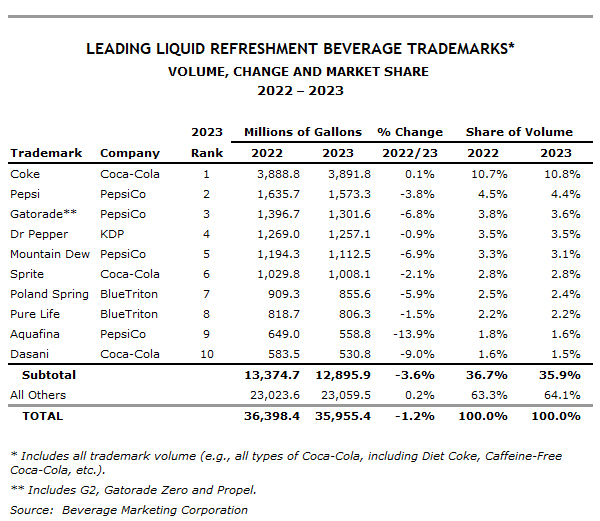

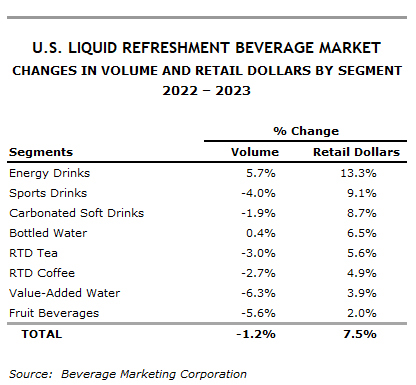

After a long string of annual volume reductions, carbonated soft drinks saw a couple episodes of growth in 2021 and 2022 only to have volume decrease again in 2023. Volume was 11.8 billion gallons, down from 12.1 billion gallons in 2022. Coca–Cola and Pepsi Cola held onto their usual first and second positions among the 10 leading beverage trademarks in 2023, with Dr Pepper and Mountain Dew claiming fourth and fifth place. Only one of the leading carbonated soft drink brands (Coca–Cola) experienced volume growth.

Bottled water, the biggest U.S. beverage category by volume, became slightly larger in 2023. The segment's principal properties — convenient, healthful, natural and calorie–free — continue to attract consumers. Volume inched up by 0.4%, which was slower than in many recent years but stronger than total liquid refreshment beverage volume, which declined by 1.2%. Retail sales, in contrast, advanced by a rate slightly slower than the refreshment beverage market as a whole did. Bottled water had four entries among the leading trademarks in 2023, but none of them grew.

Energy drinks were easily the standout segment in 2023. Volume increased at a solid 5.7%, and retail sales swelled by a double–digit rate, a feat not matched by any other refreshment beverage. Sports drinks' retail sales grew faster than overall refreshment beverage sales, but the segment's volume declined.

Like sports drinks and carbonated soft drinks, fruit beverages, ready–to–drink (RTD) coffee, RTD tea and value–added water registered declines in volume in 2023, though each segments' retail sales increased. Unlike sports drinks and carbonated soft drinks, these segments' sales grew less quickly than the overall refreshment beverage category's sales did. (Sports drinks had one brand — Gatorade — among the 10 largest by volume, but no energy drink, RTD coffee, RTD tea, fruit beverage or value–added water brand ranked among the leading trademarks by volume.)

Four companies accounted for all of the leading refreshment beverage trademarks. PepsiCo had four brands. Coca–Cola had three while BlueTriton had two and Keurig Dr Pepper had one.

"Over the years, the beverage industry has demonstrated its resilience," observed Michael C. Bellas, chairman and CEO, Beverage Marketing Corporation. "As prices start to moderate in the near future, refreshment beverage volume should return to its historical tendency to grow."

Beverage Marketing Corporation is the leading research firm dedicated to the global beverage industry.

###