New Report: Bottled Water Volume Growth Quickens in 2024, Data from Beverage Marketing Corporation Show

5/20/2025

BOTTLED WATER VOLUME GROWTH QUICKENS IN 2024, DATA FROM BEVERAGE MARKETING CORPORATION SHOW

***

Producers' sales growth also moderated somewhat again in 2024

New York, NY, May 2025: Bottled water, the largest beverage category by volume in the United States, grew solidly in 2024. This represented a rebound from the previous year, when volume barely budged and per capita consumption took an unusual dip. Per capita consumption increased by nearly a gallon to hit a new high in 2024. Sales also grew solidly, but less rapidly than in the previous few years, when higher rates of inflation elevated prices. With the accelerating volume growth and continued upward sales movement, bottled water reached new peaks in both total gallons and producers' revenues.

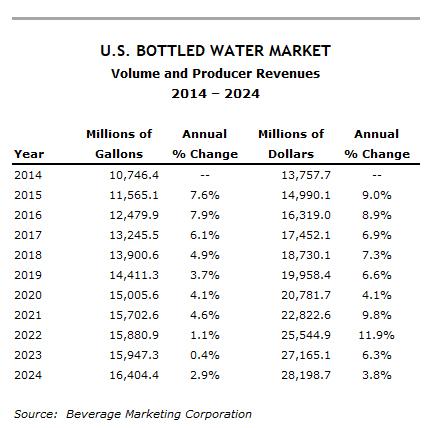

Total bottled water volume increased by 2.9% in 2024 after edging up by 0.4% in 2023 and by 1.1% in 2022. Producers' revenues enlarged by almost 4% in 2024 after swelling by more than 6% in 2023 and by nearly 12% in 2022.

Other than two relatively small declines in 2008 and 2009 — when most beverage categories contracted due to that period's financial crisis — bottled water volume grew every year from 1977 to 2024. This period included 17 double-digit annual volume growth spurts. Before the sluggishness of 2022 and 2023, bottled water volume consistently enlarged at solid single-digit percentage rates since resuming growth in 2010. Confronted with another crisis in 2020, bottled water experienced increased demand, especially early on in the pandemic in the second quarter, when consumers stocked up on what they considered essential goods. Even after pantry-loading abated, demand for bottled water remained strong, as quickening growth in 2021 demonstrated. The category's 2023 growth, while positive, was the weakest since the economic downturn of 2008 and 2009. Thus, 2024’s performance was something of a return to form.

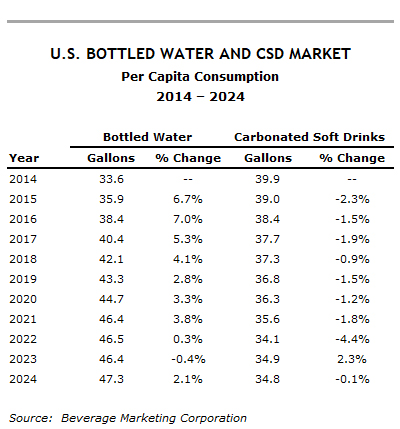

In 2024, per capita consumption reached 47.3 gallons. This more than made up for 2023's softness, when per capita consumption dipped to 46.4 gallons, down a tenth of a gallon from the year before. Consequently, per capita bottled water consumption in 2024 stood 12.5 gallons higher than average intake of the second largest beverage category, carbonated soft drinks (CSDs). Per capita soft drink consumption of CSDs dipped from 34.9 gallons in 2023 to 34.8 gallons in 2024. At the turn of the century, per capita soft drink consumption regularly exceeded 50 gallons, and Beverage Marketing expects bottled water to reach that level by the end of this decade or the start of the next.

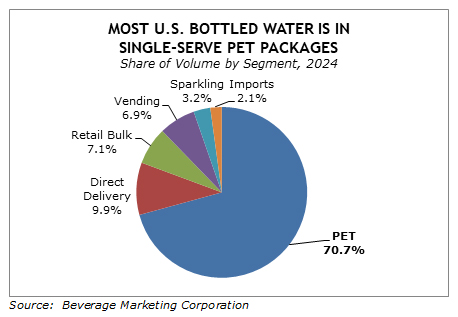

Single-serving sizes stand as the most popular bottled water type, accounting for the majority of the category's volume. In 2024, however, the single-serve segment underperformed the overall bottled category, enlarging by 2.4% to 11.6 billion gallons. Even so, this represented nearly 71% of total bottled water volume. All other segments — home- and office-delivery and self-service refill (vended) water, retail bulk (1- to 2.5-gallon multi-serve), domestic sparkling and imports — also grew, albeit at varied rates. Vended and imports registered the fastest growth; retail bulk was the slowest.

"With sought-after qualities like as calorie-free refreshment and healthy hydration as well as low prices relative to other beverages, bottled water stands as consumers' preferred beverage choice," notes Michael C. Bellas, chairman and CEO, Beverage Marketing Corporation. "These benefits propelled it to the top spot volume-wise, and they will undergird bottled water’s anticipated strong performance going forward."

Beverage Marketing expects bottled water to extend its already long record of volume enlargement, and to put even more distance between itself and CSDs, the beverage category it surpassed to become the biggest.

Beverage Marketing Corporation is the leading research firm dedicated to the global beverage industry.

###